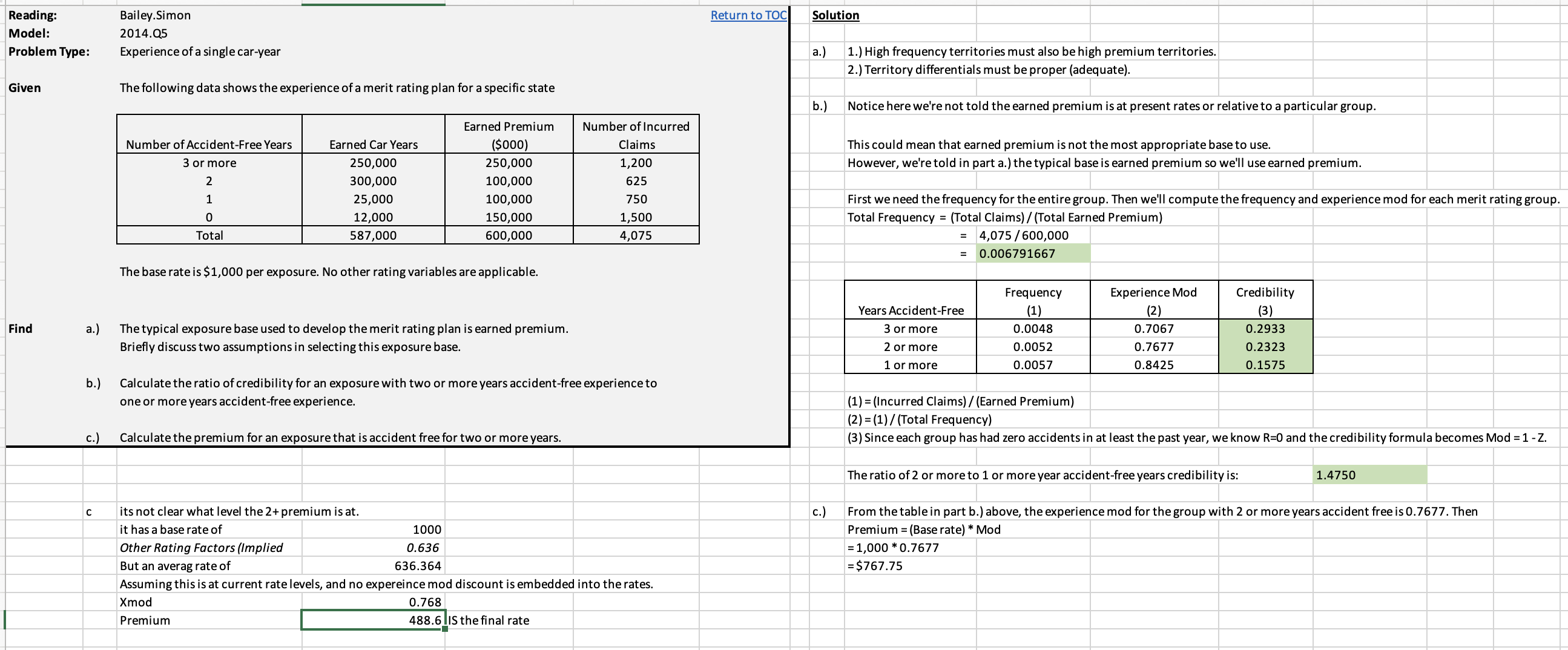

2014.Q5. Part C -

Hey Quick question on part C of this problem, which asks for the final premium. We are given base rate of 1000, but the actual rate for this group is Prem / expsoures = 636. So I applied the Xmod to that rate implied by the table level to get a final premium of 488. Does that work?

I see now that final note that "no other rating variables are applicable" - but I don't get what they are testing here. The table is inconsistent with the base rate and they didn't provide sufficient detail regarding what level of premium we are looking at in the table.

Comments

I think you'd get almost all partial credit based on your explanation. Here's why I think it's not a complete answer. You say there is a factor of 0.636 for other rating factors yet in the question it clearly says this is a merit rating plan with no other rating variables.

The issue stems from not knowing what type of earned premium we're given. To use earned premium as an exposure base we need it at present rates/relative to one of the groups. Otherwise it's implicitly embedding the current merit rating plan.

I realize you state this as an assumption and then show how to apply the Xmod. But the Xmod should be applied to the base rate and really, you're applying it to the "base rate for the 2+ years claim free" which isn't the true base rate across all groups. In effect, you're double counting with the existing merit plan differential.