2018 1 E

I have looked through the solution multiple times but I am just struggling to understand were all the parts are coming from. Here is the sample from the examiner's report.

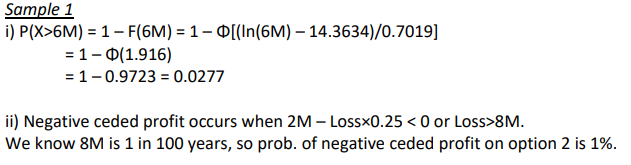

I get the the ln(6m) comes from the attachment but then I just get lost where the 14.3634 and 0.7019 come from. I get the next part is to look up that answer from the table in part D, but obviously I am missing a step.

Part ii I think I understand that it is just finding the breakeven point of the QS. I just want to make sure I am not missing anything beyond that.

Thanks!

Comments

For e part i we want the probability of the aggregate excess of loss treaty attaching. Since this is a 2m xs 6m treaty, it attaches at 6m so we want P(X>6m).

Buried within part d of the question (we hate how densely presented the information is on these pages), is the formula for the lognormal F(x).

F(x) = phi((ln(x) - mu)/sigma)

In your answer to part d you should have found mu = 14.3634 and sigma = 0.7019 so for part ei you're plugging these values into the lognormal F(x).

For part e ii we're told the ceded profit is calculated as ceded premium - ceding commission - ceded loss. If this is negative then ceded premium < 20% (ceding commission) + ceded loss. It's easiest to work with an equality though so we find the breakeven point, i.e where ceded losses = ceded premium net of ceding commission.

Since it's a 25% quota share, letting X be the losses, we cede 25%X.

The ceded premium is 25% of 10million = 2.5million but we receive back a 20% ceding commission on this = 500,000. So the ceded premium net of ceding commission is 10m*(25%)*(1-20%) = 2m. From here we can solve for the breakeven X and then find the associated probability.